Advantages And Disadvantages Of Early Retirement

Advantages And Disadvantages Of Early Retirement

Blog Article

For me, a retirement preparation layman, there are 10 steps you need to take to complete a fairly beneficial retirement strategy. Each step develops upon the other until you finally get to a list of actions that provide you a much better opportunity of having the kind of retirement lifestyle you are hoping for. In this short article, I will introduce ten actions to develop a good plan.

You can invest in a variety of locations, this choice naturally depends on your hands. Investment choices are lots of and whether dangerous or not, it is made sure that you will get enough funds for your retired life. It is advised to invest your cash in a safe location so that you don't lost the majority of your cash, but a little revenue is ensured. When you take up big dangerous investments, there is always the risk of losing all you have actually put forth, however if it clicks a substantial profit will be the outcome. The choice of investments, as pointed out above, is in your hands.

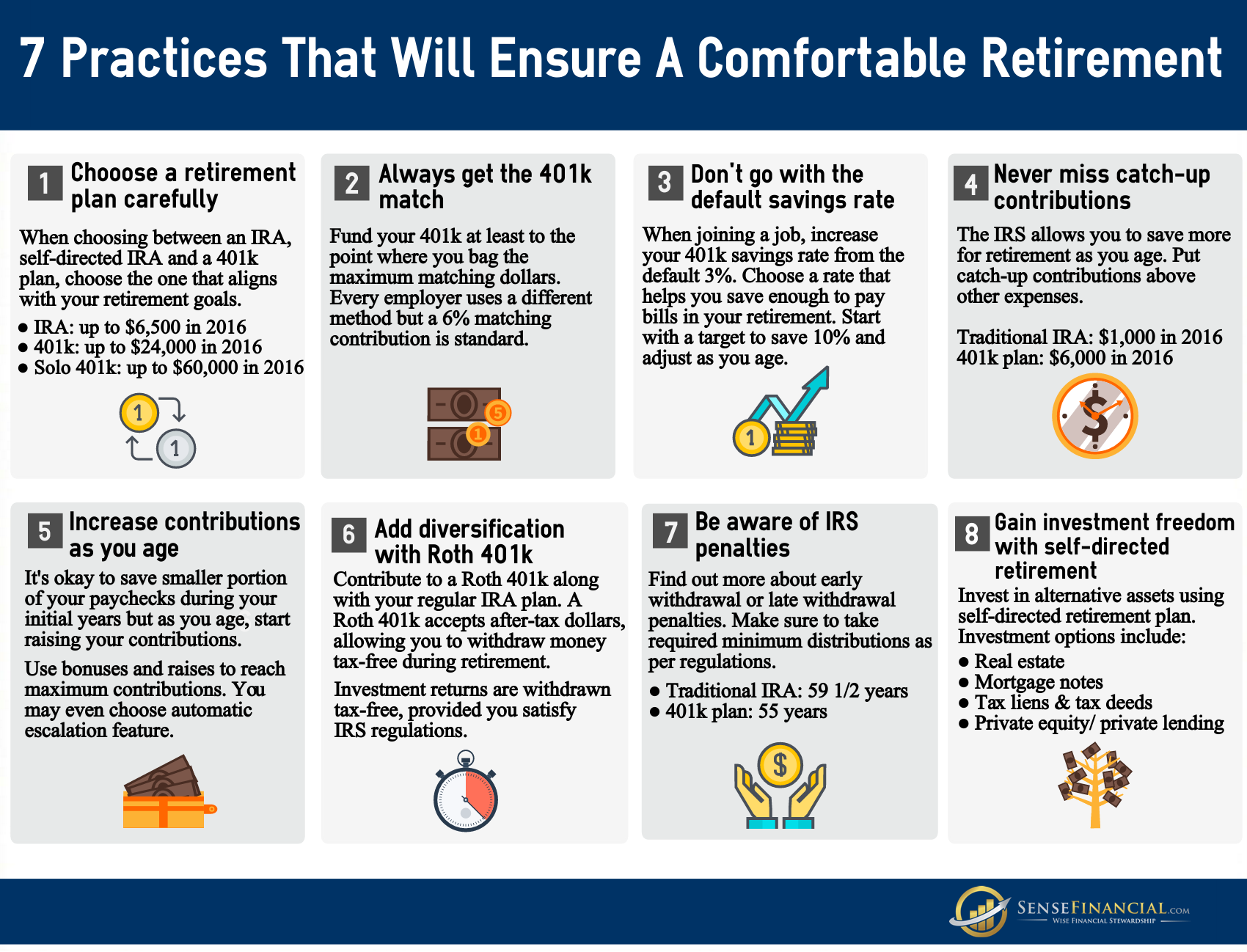

There are a variety of retirement plans and pension plans that help those who want to make a saving for their future. INDIVIDUAL RETIREMENT ACCOUNT (Person Retirement Account) is a cost savings account that many individuals choose to make their future safe. This is one protected place where individuals deposit fixed money. Some deposit monthly, and some schemes request for an annual payment. This cash is purchased various revenue making strategies like Real estate, or shared funds, stocks and so on for including earnings even more. Hence buy the time you retire, you likewise an excellent amount waiting you so that you are as abundant as you remained in your youth.

Absolutely nothing is chillier and lonelier than old age. Being economically self enough can offer a lot of heat in all aspects, psychological, social retirement planning and familial. There is honey if there is money. There is a stats about retirement planning. To take pleasure in at least half the high-ends that you take pleasure in today, you need to conserve a minimum of quarter of your earnings for the retirement. This is considering today rate of inflation. Yes it is a bit idealistic. However if we might conserve half of what is ideal it would offer us a firm helping hand.

It's practically humorous where some individuals will go when they are preparing for their retirement. Some in fact listen to the guidance of pals or co-workers. While this philosophy may have worked back in the days where any stock went up on any provided day, today's investing is far various.

Series Of Returns - If you're far from retirement, the series of your portfolio returns are not as important. They play a much bigger function if you're within 5 years of retirement.

The general retirement age is 65, while many get social security benefits beginning at 62. Nevertheless, we are beginning to see lots of people developing into their seventies and eighties, retiring much later on than they did previously. You will require to make a good quote of when you believe you will retire, but 65 is probably a safe guess.

When you are searching for a reasonable IRA that you can set up, you need to always investigate it correctly. Just if you feel that this is the choice that is most comfy and effective for you, need to you go on with the strategy. Any retirement plan likewise requires you to satisfy a set of conditions for you to access them. So, choose right and make a delighted retirement for yourself.

Report this page